Recent changes to the Capital One Quicksilver card Many rewards cards require users to spend between $1,000-$3,000 on their card to get a welcome bonus, but Quicksilver cardholders only have to spend $500.

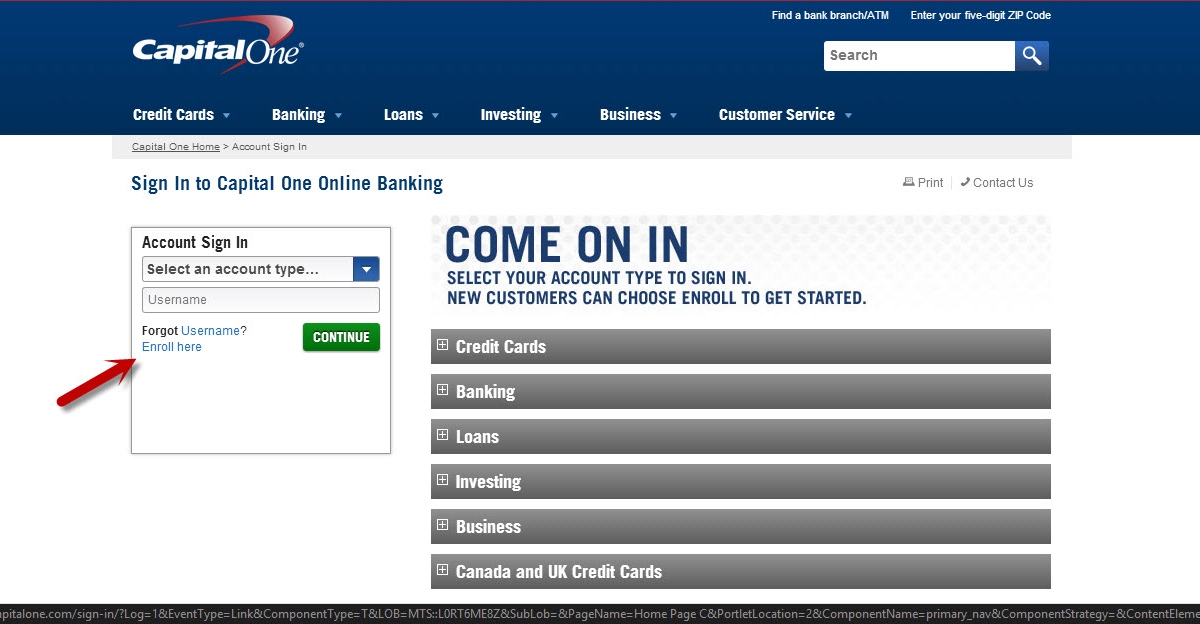

Plus, the $200 sign-up bonus is on the higher side for a card with no annual fee and is one of the easiest to earn. You might not get quite as much value out of your rewards without bonus categories, but the Quicksilver card is still a good option for those who don’t weigh their spending heavily toward any one kind of purchase. $200 sign-up bonus if you spend $500 in first 3 monthsĮstimated earnings in first year ($15,900 spend) Here’s a quick look at what cardholders can earn in the first year.Ĭapital One Quicksilver Cash Rewards card Since the Capital One Quicksilver card offers a flat cash back rate, you won’t have to keep track of any rotating bonus categories to earn competitive rewards. See related: Best Capital One credit cards What is the Capital One Quicksilver card worth in the first year? That’s up $50 from the card’s previous bonus while still requiring the same minimum spend. The Capital One Quicksilver Cash Rewards Credit Card now carries sign-up bonus of $200 cash back after spending $500 in the first three months.

Along with an elevated sign-up bonus on its no annual fee dining rewards card, the Capital One SavorOne Cash Rewards Credit Card, Capital One is currently offering a new bonus for fans of flat-rate cash back.

0 kommentar(er)

0 kommentar(er)